Canadian stock exchanges outperform the S&P 500, which is why

Article content

Article content

Article content

According to CIBC analysts, currency movement matches what CIBC analysts say in Donald Trump’s tariff war and actually promotes the Canadian stock market.

According to analyst Ian de Verteuil, the dollar has been sliding on slides this year, partly because of the shocking perception of the U.S. economy, but also because of the feeling that Trump wants to see a weak dollar.

“This coincides with speculation from White House officials of “Mar-a-Lago Accord” to deliberately weaken the U.S. exchange rate,” he wrote in a recent note.

Advertisement 2

Article content

Another twist is that the Canadian dollar is weak at the same time.

Since the beginning of the year, Canada’s major stock exchanges have outperformed the S&P/500, “The net effect of currency changes has and should continue to be beneficial to the S&P/TSX.”

Gold is the reason.

When the dollar falls, gold prices usually rise. This has happened 77% of the time in the past 47 years, according to CIBC Tracking.

The dollar fell 2.3% in the first week of March, with gold last week going bankrupt for the first time at $3,000.

“The reality is that whether it’s explorers, producers or royalties, the Canadian index has become the “home” for gold companies, regardless of where their mines are located,” de Verteuil wrote, adding that gold stocks currently account for 10% of the index’s market capitalization.

“The dollar is weak and helps support gold prices, and a large part of the S&P/TSX market capitalization.”

Another reason is that TSX’s main exchanges as a trading country are essentially global, and a considerable portion of its revenue comes from abroad. CIBC said only 48% of the index’s revenue comes from its Canadian operations.

Article content

Advertisement 3

Article content

“This should provide revenue throughout 2025 due to the majority of revenue from S&P/TSX bookings outside Canada,” De Verteuil said.

The biggest winners are companies with a large amount of non-Canadian revenue, but in the Canadian dollar price report: “Not only do they benefit from diversification outside of Canada, but also in the first and second quarters of 2025, they are likely to have positive surprises on earnings.”

Sign up here to deliver descendants directly to your inbox.

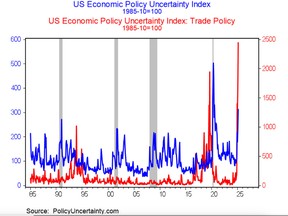

Sal Guatieri, senior economist at CBIC Capital Markets, said uncertainty in U.S. economic policy has not been so high in 40 years.

The surge in unpredictability presents a special challenge for Canadian banks because it can balance the impact of uncertainty on the economy and ensure that “the tariff issue does not become an inflation issue.”

“The odds of a pause in April have risen, although if the tariffs do put the economy into recession, the bank may need to “quickly lower interest rates as things crystallize,” Guatieri said.

- Today’s data: New U.S. Home Sales, Building Permits and Conference Committee Consumer Confidence

- income: McCormick & Co. Inc.

Advertisement 4

Article content

Older millennials or younger people who think they need to save money may wonder: Is 40 too old to build wealth passed down from generation to generation? Starting a journey to build wealth after 40 may seem like a challenge, or it feels too late to put an important nest egg together, but there are some things you can do – you shouldn’t. learn more

Will the trade war affect your financial situation? Do you make different decisions about spending or saving habits? Has it changed your retirement math or portfolio structure? Do you see bigger plans like buying a home or starting a family that glides on your fingers? If yes, please give us a lines@postmedia.com via your contact information and we will help you when writing a family financial story about it (and of course, we keep your name out).

McLister mortgage

Want to learn more about mortgage loans? The Financial Postal Column by mortgage strategist Robert McLister can help you navigate complex industries, from the latest trends to financing opportunities you don’t want to miss. Add to his mortgage rate page to learn about Canada’s lowest national mortgage rates, updated daily.

Advertisement 5

Article content

Financial Positions on YouTube

Visit Financial Post’s YouTube channel to be interviewed by leading experts in Canada’s business, economy, housing, energy sector and more.

Today’s descendants are written by Pamela Heaven, along with financial postal staff, Canadian media and other reports from Bloomberg.

Have a story idea, publicity, embargo report or suggestions for this newsletter? Send us an email to postthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know – add FinancialPost.com to your bookmark and sign up for our newsletter here

Article content