The richest people of the UK are truly a mixed picture. In 2025, many people who are the pinnacle of the list are the most important, owners of some of the British or even the world’s highest profit-generating businesses.

Investment and banking is a common source of billionaire wealth in the UK, but the wealth of the richest people in the country comes from surprisingly diverse sources. There is construction equipment, chemical manufacturing, gambling and even in the top ten alone.

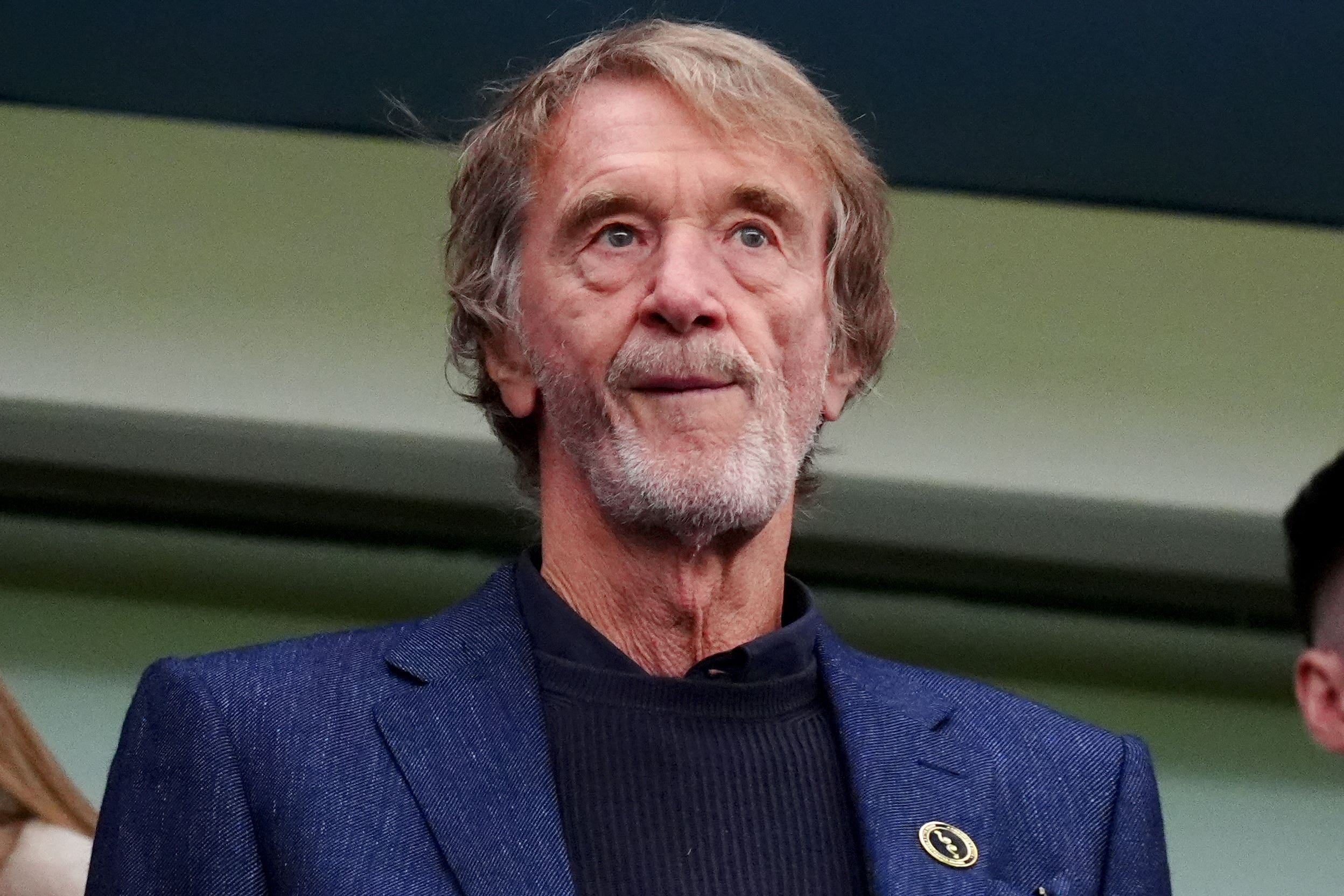

Publications like each year The Sunday Times and Forbes Reconsider the wealth of the richest people in the UK to find out who has risen or fell over the past 12 months. Michael Platt, manager of hedge funds, became the richest person in 2024, with a massive turnout from the tenth in 2023. He Leapfrogs Ineos and Manchester United – Owner Jim Ratcliffe in second place, while James Dyson jumped to third.

Although the net worth of some of these individuals may seem astronomical – and that is – the richest people of the UK are not one of the richest in the world. In fact, Mr. Platt, the richest of the UK, only in 104th place. The top three remain based on US, with Elon Musk ($ 195 billion), Jeff Bezos ($ 194 billion) and Mark Zuckerberg ($ 177 billion) all taking the best places.

Here is the latest list of the richest people in the UK and their current estimated net worth:

1.. Michael Platt – £ 14.29 billion

The UK’s richest man, Michael Platt, is a billionaire hedge fund manager with an estimated net worth of £ 14.3bn. He founded BlueCrest Capital Management, Europe’s third largest hedging firm, in 2000 and is currently his managing director.

Mr. Platt was born in 1968 in Preston, Lancashire, and graduated from the London School of Economics in 1991 after studying math and economy. He joined JP Morgan the same year and fully started his investment career.

2. James Ratcliffe – £ 13.1 billion

Mr. Ratcliffe, known much like Jim, recently received prominence for his decision to become a minority shareholder of Manchester United Football Club. In 2018, he was the richest person in the UK, but has only lost the top position ever since.

Mr Ratcliffe is a chemical engineer and businessman, currently chairman and CEO of Ineos Chemicals Group which he founded in 1998. He was born near Manchester and studied at the University of Birmingham with a degree in chemical engineering. Its net worth is now £ 12.62 billion.

3. James Dyson – £ 10.8 billion

Since the early 90s, James Dyson has been a household name for his ever -growing range of innovative vacuum cleaners. His products have since expanded to high-end fans, heaters and even hairdryers.

Get a free fractional share worth up to £ 100.

Capital at risk.

Conditions apply.

Go to the site

Get a free fractional share worth up to £ 100.

Capital at risk.

Conditions apply.

Go to the site

Dyson’s massive success has seen its owner become one of the richest people in the UK, with a net worth of £ 10.64 billion today.

Alexander Gerko, who was born in Russia, has been established in the United Kingdom since 2006. He is a successful financial trader and founder of XTX Markets, an algorithmic trading business.

Mr. Gerko, a British citizen, renounced his Russian citizenship in 2022. He was trained at the University of Moscow, but now lives in North London with his three children and wife, who is an economist from Bank of England.

5. Denise Coates – £ 7.94 billion

Denis Coates is the founder and joint CEO of Bet365, a British gambling company in Stoke-on-Trent. She has been the highest paid female CEO for several years and took home £ 150m in 2024.

Ms Coates founded the Bet365 in 2000 and launched an online gambling with a £ 15m loan the following year. She founded the business with her father, Peter Coates, a board director and former chairman of Stoke City Football Club.

6. Christopher Hohn – £ 7.54 billion

Sir Christopher Anthony Hohn is founder and CEO of the Children’s Investment Fund Management, a UK hedge fund management firm. It is one of the most profitable hedge funds in the world.

The business is unique in a successful philanthropic arm, the Children’s Investment Fund Foundation. Through the charity, Sir Christopher is one of the most prominent philanthropists of the United Kingdom, giving £ 601m in 2024 – 9.9 percent of its total wealth.

7. David and Simon Reuben – £ 7.46 billion

In sixth place are the Rueben brothers, David and Simon, who made their billions of rands in metals and real estate investment. They are now mainly focused on real estate, venture capital and private equity.

In 2021, the brothers each bought a ten percent stake in Newcastle United Football Club, the other 80 of which were purchased by the Saudi Arabia Public Investment Fund. David and Simon, born in Bombay, India in 1941 and 1944, respectively, moved to London in the 1950s where they were raised in Islington.

8. Nik Storonsky – £ 6.27 billion

40-year-old Russian-born Nikolay Storonsky, one of the youngest on the list, is co-founder and CEO of Revolut, a British online bank and Fintech Company. He is also the founder of the venture capital firm Quantumlight.

Storonsky, who was born just north of Moscow, studied at the University of the city in 1984 before moving to England in 2004. In 2022 he waived his Russian citizenship and condemned the country’s invasion of Ukraine.

9. Anthony Bamford – £ 6.11 billion

Anthony Bamford has been chairman of JC Bamford Excavators Limited since 1975, when he succeeded his father, Joseph Cyril Bamford. The yellow Earl of JCB, founded in 1945, has since become an icon of British construction.

In 2013, Anthony Bamford joined the House of Lords, who made Baron Bamford of Daylesford. Next to his family, Mr. Bamford a large donor to the Conservative Party, which gave a joint £ 3.2m between 2019 and 2024.

10. Joe Lewis – £ 5 billion

British businessman Joseph Lewis is the most important investor in the Tavistock squad, who owns more than 200 companies in 15 countries. He has been based in the Bahamas since 1979 after the sale of the company that made his initial wealth. He continues to run his business out of the country, which is a tax paradise.

Through the Enic group, the company of Mr. Lewis also the majority owner of Tottenham Hotspur Football Club. He was born in East London in 1937 and left school at 15 to help run his father’s catering business.

11. Clive Calder – £ 4.53 billion

South African-born Clive Calder became a billionaire in 2002 after selling his company, Zomba Group, for £ 2.7bn. Mr Calder founded the company with Ralph Simon in 1971 and formed a successful record label Jive ten years later.

Jive Records would sign American artists such as DJ Jazzy Jeff and Aaliyah in the early 1990s, and later moved to pop performances such as Backstreet Boys and Britney Spears. In 2011, the label would be deviated by the owners RCA.

12. John Reece – £ 4.21 billion

Chartered accountant John Reece joined Chemicals Company Ineos as financial director in 2000, less than two years after it was founded by owner Jim Ratcliffe. He still sits on the company’s board and holds a minority interest in the massive company.

13. Andrew Currie – £ 4.21 billion

Andrew Curries was brought into Ineos in 1999, just a year after it was founded as director. He was a graduate of the natural sciences at the University of Cambridge and began his career with 15 years at BP. Mr Curries still holds a minority interest in Ineos.

14. Tom Morris – £ 3.81 billion

Tom Morris has been the owner of the British Retail Chain Home Bargins since 1976. He establishes the company 21 years old in its hometown of Liverpool, where the highest concentration of the stores can still be found.

There are now more than 600 home bargains in the UK, employing more than 34,000 staff members. The business is still growing and opening 31 locations last year.

15. John Coates – £ 3.65 billion

John Coates is co-CEO of Bet365 with his sister, Denise, who founded the business. Both siblings own a quarter of the firm that is one of the largest online gambling companies in the world.

In 2015, Mr. Coates Vice Chairman of Stoke City Football Club.

If you invest, your capital is at risk and you can return less than invest. Past performance does not guarantee future results.