[ad_1]

The US is dangerously close to entering a formal economic recession and could face something worse on the horizon, a billionaire investment expert warned on Sunday.

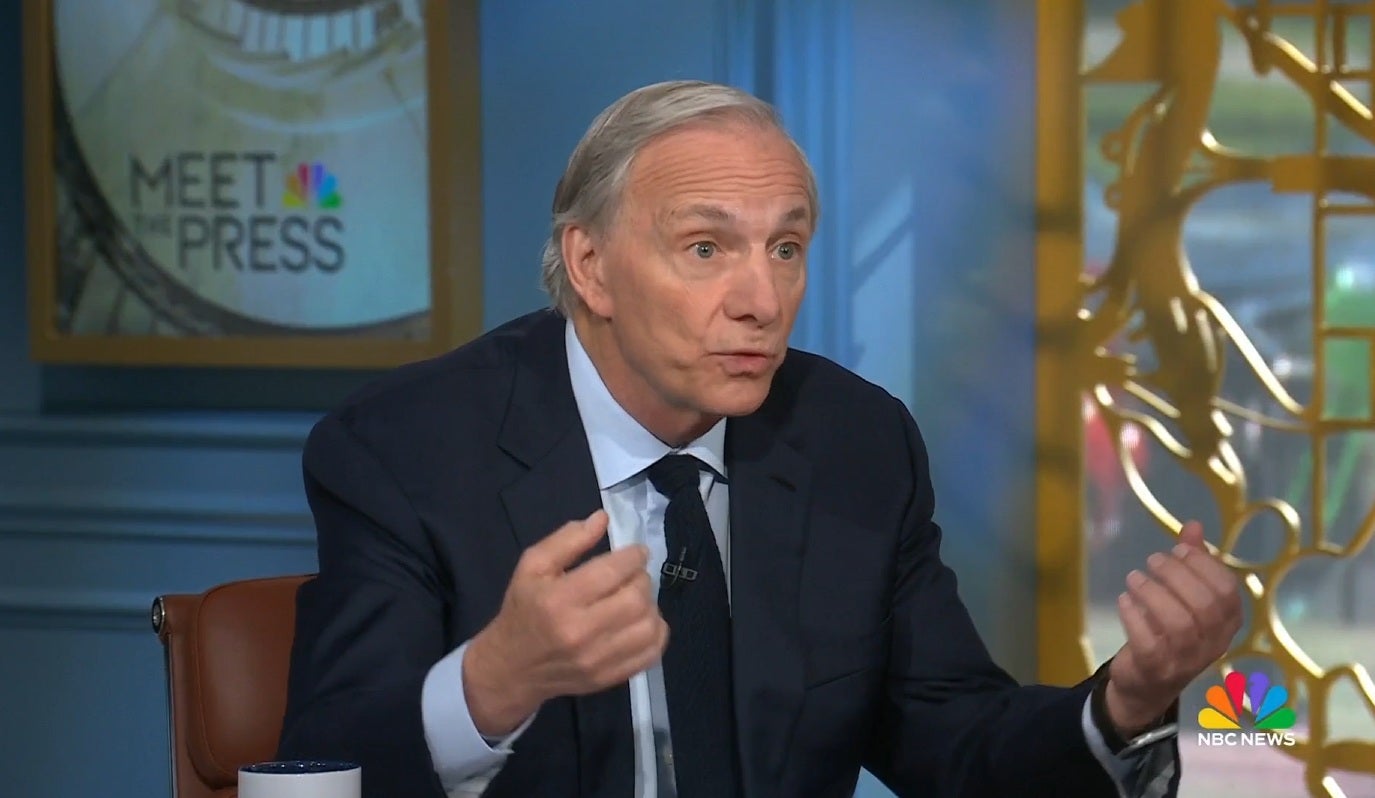

Ray Dalio, founder of Bridgewater Associates, appears on NBC’s Meet The Press, where he warned that the ‘disruptive’ nature of Donald Trump’s tariff announcements is causing market stability and making it difficult for US business and global trading partners to rely on the US.

A Wall Street veteran who predicted the collapse of the housing bubble in 2008, which caused a financial crisis that year, told Kristen Welker of NBC that the chance to stop “something worse than a recession” amounts to how the White House has strategically declared the world’s advisers:

‘We have profound changes in our domestic order […] And we have profound changes in the world order. Such times are much like the thirties, ”says Dalio.

“So if you take rates, if you take debt, if you take the rising force that challenges existing power, if you take the factors and look at the factors – the changes in the orders, the systems, are very, very disruptive,” he continued. “How it is handled can produce something that is much worse than a recession. Or it can be handled well. ‘

Dalio – which has a net worth of $ 14 billion – repeats what it has on several occasions, warned: that he believes that the growing US federal debt, now at over $ 36 trillion, is a ticking time bomb that impedes the US ability to spend in the future.

“We have a breakdown of the money order,” Dalio warned. ‘We’re going to change the money order because we can’t spend the amounts of money [we want]. “

He continued: “I believe that members of Congress must take the promise, which I call the 3 percent promise. It somehow that they will get the budget deficit to the number. If they do not, we will have a question/question problem for debt at the same time as we have these other problems.

Its warnings come after days of stock market instability, powered by technical shares and other industries struck by the new rates of the White House and arise by the constantly changing nature of the policy itself.

Late Friday night, Trump’s Customs and Border Protection Agency issued a notice that issued smartphones, solar cells and other imports applicable to the US technological sector of both sky height “reciprocal” rates on China and its lower baseline rate of 10 percent on all imported goods. It was a victory for companies like Apple, but one who died on Sunday when Howard Lutnick, secretary of the trade, warned that these rates would occur again within one to two months.

It is unclear whether the president will leave the rest of his very bad “reciprocal” tariff rates against dozens of US trading partners, including the EU, Japan, Canada and Mexico. Trump cabinet officials and advisers of the White House could not give a clear answer whether the rates or the president’s tariff rate of the orchard of the orchard of the orchard is from the orchard is simple negotiating tactics and can be rolled back, or whether they will remain in place for the duration of his term.

Other industry leaders have acknowledged what the White House officials repeatedly claim: that the rates are at least semi-permanent, because the president seeks to force US businesses and foreign investors into land production and manufacturing in the US to sustainable access to US markets.

“What we see now is a structural shift, powered by policy, which is likely to be long -lasting,” Felix Stellmaszek, global lead of car and mobility at Boston Consulting Group, told CNBC on Saturday.

“This is perhaps the most resulting year for the automotive industry in history – not just because of immediate cost -pressure, but because it forces fundamental change in how and where the industry builds.”

[ad_2]

Source link