[ad_1]

Prices could increase and staff working hours as the increase in employer’s National Insurance Contributions (NICS) comes into effect on Sunday, ministers have been warned.

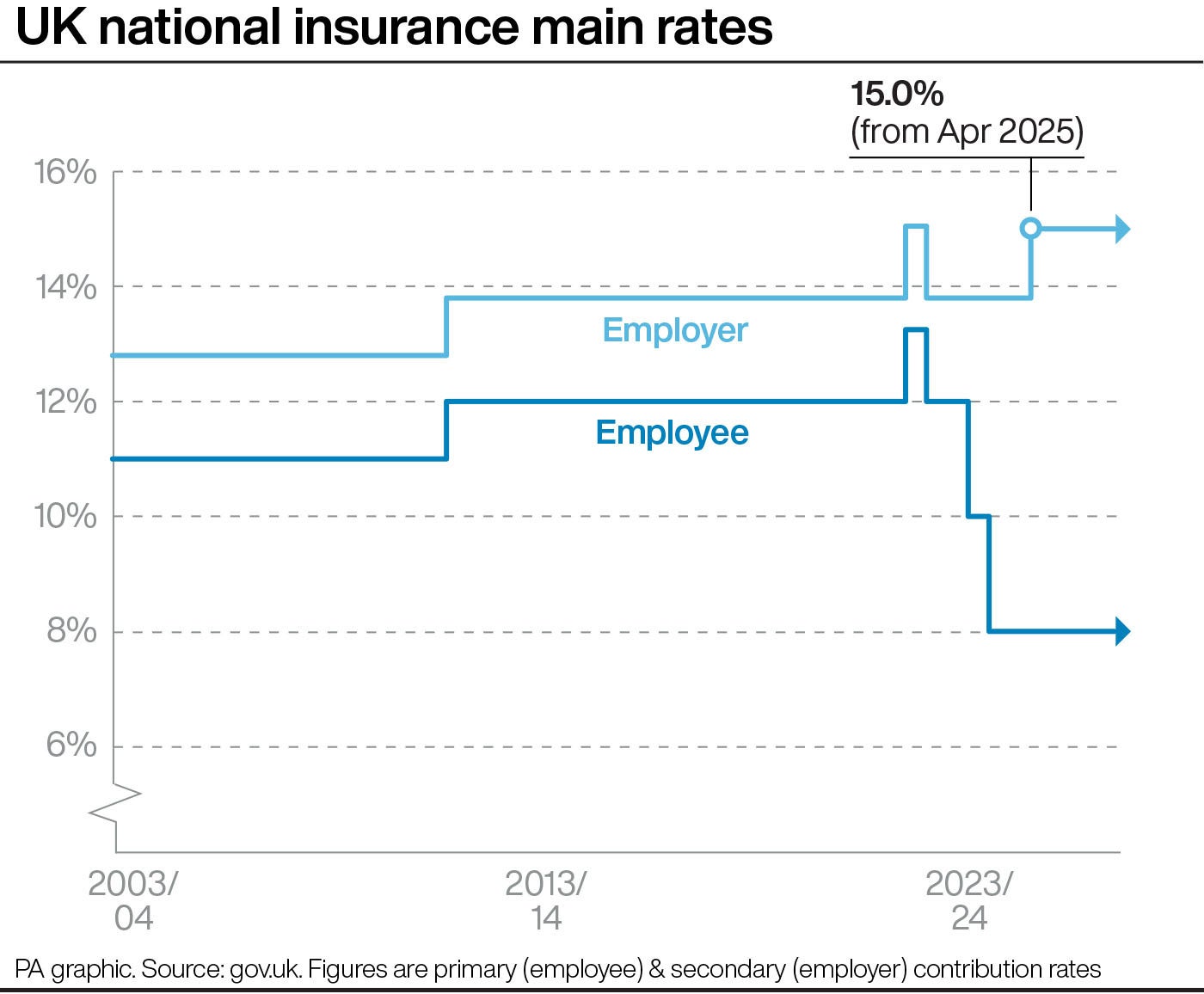

From Sunday, the rate of employer -Nic’s will rise 1.2 percentage points to 15 percent, affecting £ 5,000 earnings, lower than the previous threshold of £ 9,100.

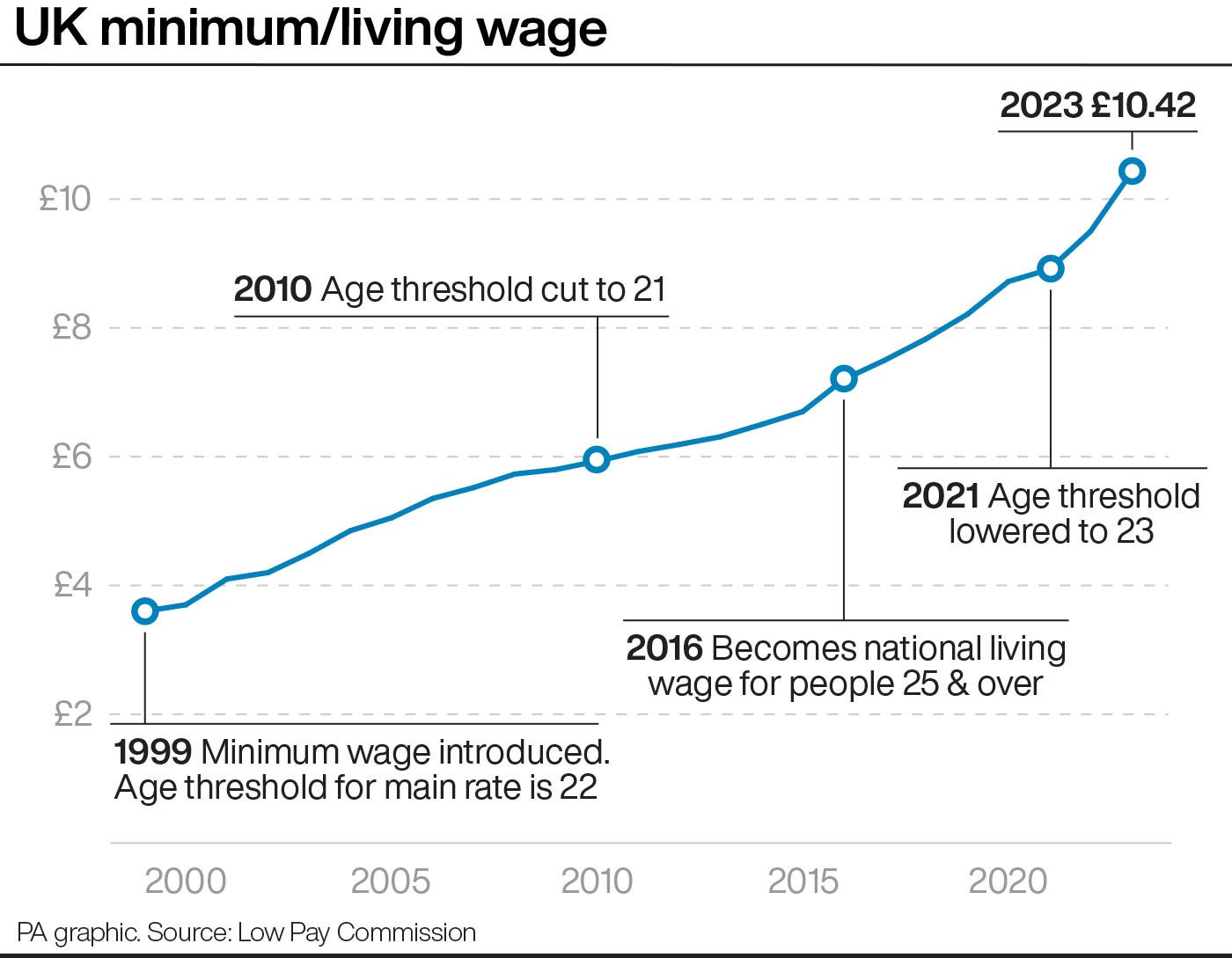

This tax increase, which branded a “work tax” by the conservatives, gets hot on the heels of a minimum 6.7 percent wage increase that was implemented last week.

The joint impact of these changes has caused concern in the hospitality sector, with industry leaders warning a negative impact on job creation.

The increased costs for businesses can lead to difficult decisions, including possible price increases for consumers and a reduction in staff working hours.

UKHospitality CEO Kate Nicholls said: “The increases to employer’s national insurance contributions will make businesses and workers across the UK.

“The consequences will be sharp, with hours for staff reduced, trading hours shortened, prices have increased and in the worst case has lost jobs.

“These harmful increases are not only hitting cherished hospitality rooms and communities, but the government’s ambition to get people back into work. It needs sectors like hospitality to create the job to get people out of the welfare system, but this tax increase will have the opposite effect on job creation.”

Ms Reeves said at last year’s budget that the move would raise £ 25 billion a year by 2029, and that she did not make this decision lightly.

The conservatives have accused the government of having a criminal tax with a criminal tax.

Andrew Griffith also said that US President Donald Trump, Shadow Business and Trade, Andrew Griffith, said: ‘British firms are already on their knees-now deliver a one-two punch they can flatten.

“They don’t understand that it’s business, not a big government, that drives growth. If they do not turn around quickly, working people will pay the price. ‘

The Liberal Democrats say that the NICS increase will be a ‘hammer blow’ for businesses.

The party’s spokesman’s Treasury spokesman Daisy Cooper said: “In the current climate, it threatens to turn our high streets into ghost towns.

“The government must think, collect the work tax and raise this money fairly by asking the big banks and digital giants to pay their fair share.”

Sir Keir Starmer acknowledged earlier this week that the living crisis is underway and that people are experiencing the pressure of rising domestic accounts, but they point to the minimum wage increase.

The beginning of April also had an increase in council tax and energy accounts for households.

He told Sky News: ‘I think to most people they would tell that the living crisis is going on, and that they feel the pressure financially.

“Therefore, it is so important that we are good at our promise that people would feel better off and that the national living wage will affect today with an average of £ 1,400 millions of people, so in their pay package this month, and of course for the coming months, they will now get more money.”

[ad_2]

Source link