[ad_1]

Donald Trump’s reciprocal tariffs could undermine global demand and spill over Canadian economy

Article content

Article content

Article content

Some may think Canada avoided a widely predicted recession after dodging Donald Trump’s reciprocal tariff bullets on Wednesday, but economists are still warning that this year’s economic contraction remains.

Economists have been calling for Canada to fall into a recession in the second quarter of Trump’s announcement of tariffs, ranging from 10% to 49% of countries around the world, but Canada and Mexico are still subject to the previous 25% tax unless the Missico Agreement (CUSMA) of Canada, New York, is in line with the Canadian state’s collection.

Advertisement 2

Article content

“The negative impact of U.S. tariffs on the Canadian economy remains huge,” Charles St-Arnaud, chief economist at Credit Union Central Credit Union, said in a note on Thursday.The economic contraction in the second quarter of 2025 is quickly becoming a reality.

He said Canada’s economy will land “indirectly” in a hole, and Canada’s growth may shrink with growth as global tariffs “a significant negative impact on the global economy.” This will hurt growth, curb demand and lower prices, especially for commodities, leaving behind provinces such as British Columbia, Alberta and Saskatchewan.

Furthermore, if the United States falls into recession, St. Arnold says This will bring bad news to Canada’s economy as it is highly dependent on the needs of neighbors.

Calls for recession in the United States are different. Capital Economics Ltd. puts the opportunity at 30%, with a low risk, while JPMorgan Chase & Co. sets the odds at 60%.

Economists at the Bank of Nova Scotia had previously forecast U.S. growth of 1.5% to 2% in 2025 and now expect “the estimated shock of tariffs will give zero growth hints if there is no contraction.”

Article content

Advertisement 3

Article content

The pain is not over.

Canada still has a tariff rate of 25% on steel, aluminum and automobiles (minus the value of components made in the United States), while tariffs on unsuitable energy exports and potassium fertilizers are also 10%. Trump can also impose tariffs on other products, such as wood, copper and medicines.

“Extremely uncertain,” said St. Arnold.(it) It could be the killer of slow economy, and spending decisions were delayed and cancelled. ”

He suggested that if business confidence erodes, companies may choose not to postpone new investments or ultimately decide not to upgrade their aging operations and move to the U.S. if business confidence erodes

“The longer the uncertainty lasts, the wider and longer the impact on investment and the economy will last,” he said.

The tariff chaos has caused losses. The conference committee of the Canadian Consumer Confidence Index fell to a near-record low in February, while the Canadian Independent Business Barometer Federation fell to its lowest level in February. It rebounded a bit in March, but that was ahead of Trump’s latest tariff bombshell.

Advertisement 4

Article content

“These two indicators may worsen further,” St. Arnold said.

The National Bank of Canada’s economic outlook for Canada is also frustrating.

“Unless the U.S. government reverses the course, the Canadian economy is expected to slow down for the rest of 2025,” it said in a note.

But capital economics has withdrawn from their call for a recession in Canada.

“Although we will modify our forecasts to avoid recession, the outlook remains frustrating,” its economist said in a note on Thursday. “Consumer and business confidence has fallen and it is impossible to recover overnight, simply because the tariffs are relatively low. A larger 25% vehicle tariff will cause huge damage to the industry, especially given the threat that ultimately includes vehicle parts.”

Sign up here to deliver descendants directly to your inbox.

In February, Canadian exports fell 5.5%, up nearly 16% between November 2024 and January 2025 as the U.S. tariff agenda began to flow global transactions.

Advertisement 5

Article content

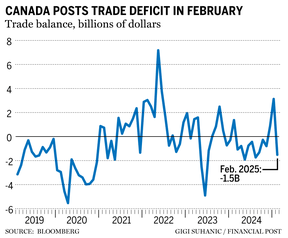

Statistics Canada said the blow to exports means that Statistics Canada’s surplus in February changed from a surplus of CAD 3.1 billion in January to a surplus of CAD 1.5 billion.

“In recent months, there has been strong fluctuations in the threat of U.S. tariffs on Canadian goods,” the data agency said on Thursday. Exports are divided into 10 of 11 categories.

Exports to the United States fell 3.6% in February and exports to other countries fell 12.4%.

Economists expect Canada to release a trade surplus of $3.5 billion.

“Looking forward, despite the USMCA (United Nations-Mexico-Canada Agreement) goods being tax-free in March, U.S. businesses appear to have accumulated enough stocks in the last few months, so exports will continue to be under pressure,” said Judge Catherine, an economist at CIBC Capital Markets.

“Although Canada escapes mutual tariffs, export demand for automobiles, steel/aluminum and wood will also be cut from previously announced tariffs,” she said.

- Fed Jerome Powell talks about economic outlook

- Today’s data: Number of jobs in Canada and the United States in March.

Advertisement 6

Article content

If you don’t prepare your own tax return every year, you’ll miss the best education about our Canadian tax system. Every week of the tax season, Jamie Golombek receives dozens of emails from readers asking various questions. He said many people are excellent and need some research to respond correctly. But others have shown that some Canadians don’t have a good understanding of how our tax system works. This week, Golombek brings readers back to the basics and takes a closer look at how Canada’s personal tax system works with its gradual tax scope, deductions and credit. Continue reading here to learn more.

Advertisement 7

Article content

McLister mortgage

Want to learn more about mortgage loans? The Financial Postal Column by mortgage strategist Robert McLister can help you navigate complex industries, from the latest trends to financing opportunities you don’t want to miss. Add to his mortgage rate page to learn about Canada’s lowest national mortgage rates, updated daily.

Financial Positions on YouTube

Visit Financial Post’s YouTube channel to be interviewed by leading experts in Canada’s business, economy, housing, energy sector and more.

Today’s descendants are written by Gigi Suhanic and reported by Financial Postal Staff, Canadian media and Bloomberg.

Have a story idea, publicity, embargo report or suggestions for this newsletter? Send us an email to postthaste@postmedia.com.

Recommended from the editorial

-

Why economists think the Canadian dollar is “worst situation”

-

Trump’s U.S. “Unreliable Hostile Point” puts Canada in danger

Bookmark our website and support our journalism: Don’t miss the business news you need to know – add FinancialPost.com to your bookmark and sign up for our newsletter here

Article content

[ad_2]

Source link