[ad_1]

The risk of recession in the United States is rising, and the Federal Reserve begins to “surpass” Canadian banks

Article content

Article content

Article content

Economists say the Canadian dollar has been a tough year so far, but the worst may have ended.

Desjardins Group is canceling forecasts that Loonie will drop to 67.56 cents this year, and now it is forecasting it will last between 70.92 and 68.96 cents over the next three months.

Why change it? This year changed, and suddenly the Federal Reserve “surpassed” Canadian banks.

Advertisement 2

Article content

The risk of recession in the United States is rising, and on March 19, the Federal Reserve said growth is becoming more and more concerned, even the impact of tariffs on inflation is “temporary”.

Inflation, on the other hand, often appears in speeches delivered at the Bank of Canada meeting on March 12.

“Canadian banks are cautious about how fast they slow down, while the Fed is waiting for hard data. Yields may shrink, especially if the U.S. labor market crashes,” said Jimmy Jean, chief economist at Desjardins and Mirza Shaheryar Baig, forex strategist.

Reducing the difference between interest rates between the two central banks will strengthen the Canadian dollar.

Meanwhile, the upheaval of Donald Trump’s new U.S. government shocked the dollar’s appeal as a safe haven.

“With the recession in the Americas, it is unlikely that the dollar will hedge risky assets as it did in the past,” Jean and Shaheryar Baig said.

They said that despite the stability and stability of the Canadian dollar against the Green Guard, it “depreciates significantly against other currencies”, which should help Canadian exporters find new markets outside North America.

Article content

Advertisement 3

Article content

If it is proposed now in the federal election to increase productivity by increasing economic reforms, you can be further grateful.

“Bringing more Canadian resources to the international market will also increase demand for Canadian dollars,” Desjardins said.

Bank of America’s forecast for the Canadian dollar is even higher at 71.42 cents, mainly because of their “optimistic view” about tariffs.

They expect oil to fly from risk to reverse the stock in March as tariff tensions are downgraded, with oil averaged $66 and a rise in the end rate at Canadian banks.

“This year, the dollar/CAD falls to our forecasts do not need to be completely relaxed,” said economist Carlos Capistran.

“In our view, the gradual shift to constructive exchanges between the United States and Canada with trade terms has made February 1 the peak tariff moment at the peak tariff moment, and we believe that in our view, the USD/CAD still makes sense.”

Sign up here to deliver descendants directly to your inbox.

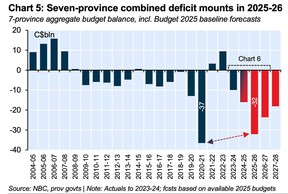

Seven budgets in 10 Canadian provinces have been exhausted, with the combined deficits as high as C$32 billion, according to estimates by the National Bank of Canada, which is twice the fiscal year’s forecast.

Advertisement 4

Article content

“Not surprisingly, the budget tone has changed dramatically relative to previous guidance, the premise and center of tariff risk,” said Warren Lovely, a national economist.

He said the provinces are now concentrated on tariffs, slower growth and lower oil prices, suggesting that red ink could grow to about $40 billion this fiscal year, a record shortage for the group.

Ontario’s budget will have to wait until the legislature regards the recovery of April 14, and the federal budget will also be put on hold after the April 28 election.

- Today’s data: US construction spending, ISM manufacturing

- income: Novagold Resources

The 65-year-old woman hopes to continue working at the age of 70 and wants to know that this will affect her Canadian pension plan and senior citizenship safety. FP Answers offers some advice on how to make the most of their investments and savings.

Advertisement 5

Article content

McLister mortgage

Want to learn more about mortgage loans? The Financial Postal Column by mortgage strategist Robert McLister can help you navigate complex industries, from the latest trends to financing opportunities you don’t want to miss. Add to his mortgage rate page to learn about Canada’s lowest national mortgage rates, updated daily.

Financial Positions on YouTube

Visit Financial Post’s YouTube channel to be interviewed by leading experts in Canada’s business, economy, housing, energy sector and more.

Today’s descendants are written by Pamela Heaven, along with financial postal staff, Canadian media and other reports from Bloomberg.

Have a story idea, publicity, embargo report or suggestions for this newsletter? Send us an email to postthaste@postmedia.com.

Recommended from the editorial

-

How can Canadians be the best weapon against Trump’s tariffs

-

Trump is wasting the United States’ reputation as a trading partner

Bookmark our website and support our journalism: Don’t miss the business news you need to know – add FinancialPost.com to your bookmark and sign up for our newsletter here

Article content

[ad_2]

Source link