[ad_1]

The choices we make at grocery stores, shopping malls and travel agencies could have a significant impact, CIBC said.

Article content

Article content

Article content

Donald Trump exerted a 25% tax on all cars outside the U.S. last week, exacerbating his trade war – a tariff he promised to reveal on Wednesday.

Prime Minister Mark Carney said the tariffs carried out a “direct attack” on Canada but retaliated against retaliation. On Friday, Trump described it as a “productive conversation” and the two agreed that trade talks would resume after the Canadian election.

Advertisement 2

Article content

However, automatic tariffs will still come into effect on April 2, and while Canada may drop with “light contact”, the fine will be a blow, especially in Ontario, where 100,000 jobs in the industry.

“With the choice in how to respond, Canadian policy makers need to consider what works most, not just what it feels right now,” said Avery Shenfeld, chief economist at CIBC Capital Markets.

Shenfeld believes that applying our own 25% tariff on U.S.-made auto parts would be self-deception because in addition to U.S. tariffs, it will also increase the price of Canadian-made vehicles.

Our tariffs on cars shipped from the U.S. are not a great plan either, as it will “significantly” Canada’s inflation and favor overseas tools that do not include Canadian content. Trump also has a risk of retaliation for higher tariffs.

Advertisement 3

Article content

Ottawa could step in to incentives to encourage automakers to continue operating their plants north of the border, but could see it as a subsidy and attract revenge again.

“Another, or at least, a supplementary measure, is to allow Canadians to fine U.S. exports through their choices among supermarkets, shopping malls, car dealers and travel agencies,” Shenfeld said.

It’s too early to see the data, but CIBC has gained anecdotal evidence from a “broad customer” that Canadians are buying and taking action to avoid the United States.

He said today’s grassroots movements can be intensified by publicly funded marketing and advertising by Canadian merchandise suppliers, retailers and travel agencies.

Article content

Advertisement 4

Article content

“This is not something the Trump administration can point to our administration and retaliate,” Shenfeld said.

“Choose not to buy something is the right of every citizen in a free society, and if joined by Mexico, Europe and Asia, it could put more pressure on the U.S. economy and its political leaders rather than separate tariffs.”

Americans themselves may be another pressure on Trump when they realize how much the next car will cost.

Douglas Porter, chief economist at BMO Capital Markets, said that over the past year, the United States has gathered 10.75 million cars and purchased 16.07 million, leaving a gap of more than 5 million cars and trucks.

Advertisement 5

Article content

Trump has said he wants to bring manufacturing back to the United States, but that could take years, “so even with the tax, the United States will import a lot of vehicles and use heavy duty as a horse.”

The president reportedly warned automakers against price increases, which could initially control prices, “but it’s hard to fight economic laws,” Porter said.

BMO expects U.S. vehicle prices to rise 10% overall, with sales falling about 5% from before the tariffs.

Sign up here to deliver descendants directly to your inbox.

David Rosenberg of Rosenberg Research & Associates Inc. said Canada’s economic growth rate exceeded January’s expectations, but the 0.4% gain doesn’t tell the whole story.

Advertisement 6

Article content

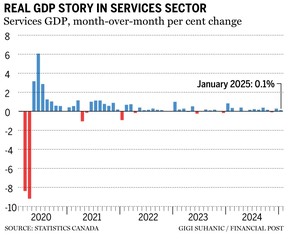

Most activity grew 1.2% in the cargo sector as exporters pushed the product ahead of the forecast U.S. tariffs this week. Services were stagnant 0.1%.

Statistics Canada predicts flat in February, while Rosenberg predicts a sharp contraction in the second quarter.

“There is a storm in the Canadian economy and the Canadian dollar is a huge sell-off,” he said.

- Air Canada Annual General Meeting

- income: Pizza Pizza Royal

Advertisement 7

Article content

The 65-year-old woman hopes to continue working at the age of 70 and wants to know that this will affect her Canadian pension plan and senior citizenship safety. FP Answers offers some advice on how to make the most of their investments and savings.

Will the trade war affect your financial situation? Do you make different decisions about spending or saving habits? Has it changed your retirement math or portfolio structure? Do you see bigger plans like buying a home or starting a family that glides on your fingers? If yes, please give us a lines@postmedia.com via your contact information and we will help you when writing a family financial story about it (and of course, we keep your name out).

McLister mortgage

Advertisement 8

Article content

Want to learn more about mortgage loans? The Financial Postal Column by mortgage strategist Robert McLister can help you navigate complex industries, from the latest trends to financing opportunities you don’t want to miss. Add to his mortgage rate page to learn about Canada’s lowest national mortgage rates, updated daily.

Financial Positions on YouTube

Visit Financial Post’s YouTube channel to be interviewed by leading experts in Canada’s business, economy, housing, energy sector and more.

Today’s descendants are written by Pamela Heaven, along with financial postal staff, Canadian media and other reports from Bloomberg.

Have a story idea, publicity, embargo report or suggestions for this newsletter? Send us an email to postthaste@postmedia.com.

Recommended from the editorial

-

Trump is wasting the United States’ reputation as a trading partner

-

Trump’s “liberation day” may be good for Canada

Bookmark our website and support our journalism: Don’t miss the business news you need to know – add FinancialPost.com to your bookmark and sign up for our newsletter here

Article content

[ad_2]

Source link